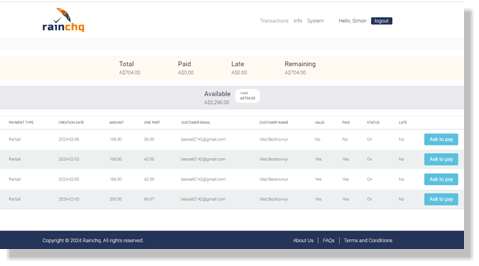

Hi, I’m Keith Clark the owner of KAC Electrical, Sydney. Since installing Rainchq, an automated accounts receivable & onboarding platform, I’ve improved my overall customer experience with a simple onboarding process for new/existing customers, payment reminders, and interest-free trade credit, should customers pay on time. Rainchq also charges penalties for late or missed payments, which encourages my customers to pay on time every time. Both my cashflow and dso (the time customers take to pay me) have improved considerably. The automated collections save time at month end, and the instalments or part payments are attractive to existing and potential customers.

I no longer have to ring hundreds of customers, often chasing small amounts. I also have the flexibility to choose, the number of collection cycles and days between them with the dynamic cycles functionality……, and all this with the security should things go wrong, Rainchq will settle 80% of the transaction or outstanding balance within 20 days of the final default.

Surprisingly easy to install with Xero, Rainchq has made my onboarding and collections easy.